Annual income calculator after taxes

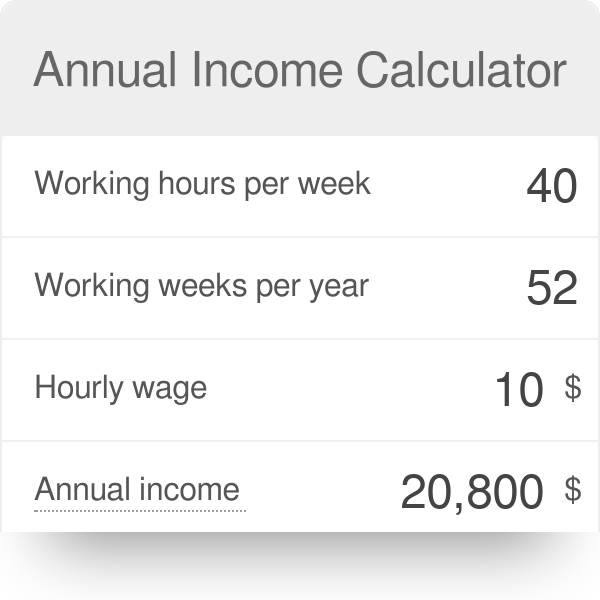

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. If your employer pays you by the hour multiply your hourly wage by the number of hours your work each week.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

The default assumes you have opted out.

. Additionally health and education cess at 4 are levied on the total tax rate above the total amount payable. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Instead of using allowances the new form applies a five-step process that requires filers to prove and enter annual dollar amounts for any.

That means that your net pay will be 37957 per year or 3163 per month. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. Ad Discover Helpful Information And Resources On Taxes From AARP.

Yes you can use specially formatted urls to automatically apply variables and auto-calculate. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate. Annual Income 31200.

These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined. Using the annual income formula the calculation would be. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. This marginal tax rate means that your immediate additional income will be taxed at this rate. Add your additional income to.

This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012. Hourly Employee with Unpaid Time Off.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Your average tax rate is 217 and your marginal tax rate is 360. Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to federal income taxes if you live and work in Texas.

The IRS made notable updates to the W-4 in recent years. Income qnumber required This is required for the link to work. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. This marginal tax rate means that your immediate additional income will be taxed at this rate. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

KiwiSaver knumber optional The percentage you contribute towards KiwiSaver. Determine your annual salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

That means that your net pay will be 43041 per year or 3587 per month. That means that your net pay will be 40568 per year or 3381 per month. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

Youll then see an estimate of your salary after-tax as well as how much you may owe in taxes. With five working days in a week this means that you are working 40 hours per week. Of course for ease of use our Canadian salary calculator has to make a few assumptions.

How Your Paycheck Works. The United States economy is the largest and one of the most open economies in the world representing. Annual Income 15hour x 40 hoursweek x 52 weeksyear.

8 hours agoCheck Out Your Federal Tax Return for Income Eligibility for Student Loan Forgiveness To qualify for Bidens student loan forgiveness plan borrowers must earn under 125000 in annual income. It can be any hourly weekly or annual before tax income. Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay.

The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. It can also be used to help fill steps 3 and 4 of a W-4 form. Your annual income would be 31200.

Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. This marginal tax rate means that your immediate additional income will be taxed at this rate. Then multiply it by 52 for the total number of weeks in a year.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Your average tax rate is 270 and your marginal tax rate is 353. This calculator is intended for use by US.

Your average tax rate is 220 and your marginal tax rate is 353. The unadjusted results ignore the holidays. The amount of federal income taxes withheld will depend on your income level and the withholding information that you put on your Form W-4.

Excel Formula Income Tax Bracket Calculation Exceljet

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Self Employed Tax Calculator Business Tax Self Employment Self

Annual Income Calculator

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Taxes And Fees Paying Financial Charge Obligatory Payment Calculating Personal Income Tax Doing Your Taxes Tax Credit Meta Filing Taxes Income Tax Income

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Tax Withholding Calculator For Employers Online Taxes Federal Income Tax Tax

Paycheck Calculator Take Home Pay Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

What Is Annual Income How To Calculate Your Salary

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Annual Income Calculator